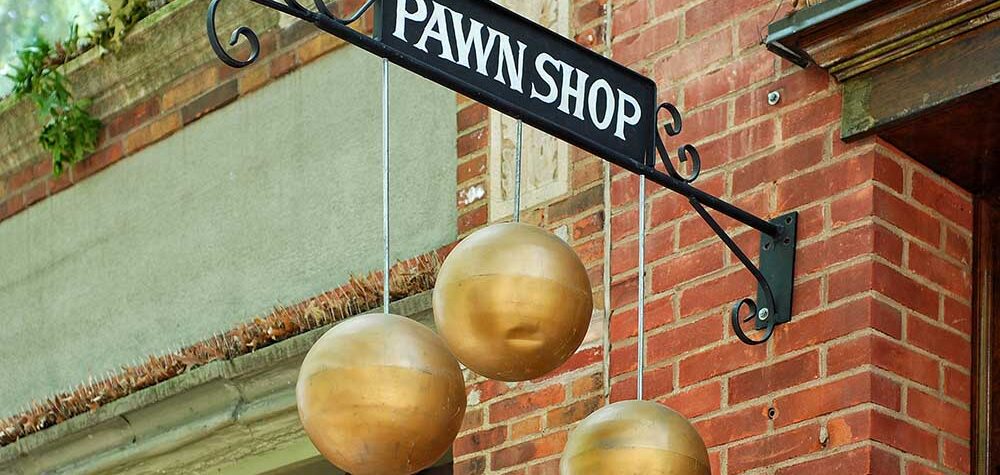

Need To Borrow Less Than $500? Pawn Shop or Payday Loan…?

If you need to borrow less than $500 and are wondering whether you should apply for a payday loan or just pawn one of your valuables, you have to weigh your options. Pawn shops aren’t going to give you very much for your valuable items because they have to make a profit. That means if you need $500 or less, you’ll need...

Dead End Loans, You’ve Got To Avoid: Part 3

In Dead End Loans You’ve Got To Avoid: Part 1 and Part 2, you had a chance to see the bad side effects of pay day loans, car title loans, credit card cash advances, casino loans and pawn shop loans. In part 3 we are going to cover other kinds of loans that may end up leaving you worse than where you...

Dead End Loans You’ve Got To Avoid: Part 2

Financial binds can trap anyone, but before you go out looking for a loan there are some options you may never want to consider. In Dead End Loans You’ve Got To Avoid: Part 1, we covered payday loans, car title loans and tax preparer loans. Now in part 2 we are going to cover some other kinds of loans you may want...

Dead End Loans You’ve Got To Avoid: Part 1

A tight financial bind usually pushes people into making desperate financial decisions. Those decisions usually show up in the form of loans. While not every loan is bad, some loans should be avoided at all costs. In part one of Dead End Loans You’ve Got To Avoid, you will see three kinds of loans that could leave you in a worst off...

Ouch! You’ve Just Been Denied Credit – Here’s What To Do Next

So, you’ve applied for a loan and found out you were DENIED. You probably feel bummed, but you may also be wondering what to do next. Before you get up in arms about the situation, see this as a great opportunity. Now you have a chance to investigate any issues that are likely lurking on your credit report. Here are the next...